Financial Aid & Scholarships

Financial Aid & Affordability

Financial aid is any assistance that is provided to support families with paying for college education. This can come from the federal government, the state government, the college or institution itself, or outside sources.

The most complex thing about financial aid, college costs, and affordability is that it varies greatly by individual family and by institution. The same college could cost literally $0 for one student, while costing another student $80,000/year. So, one of the most important places to start in understanding financial aid is your family’s unique financial situation, which will help determine what colleges are a fit for you. Considering financial fit when making a college list is KEY.

The Process... Simplified

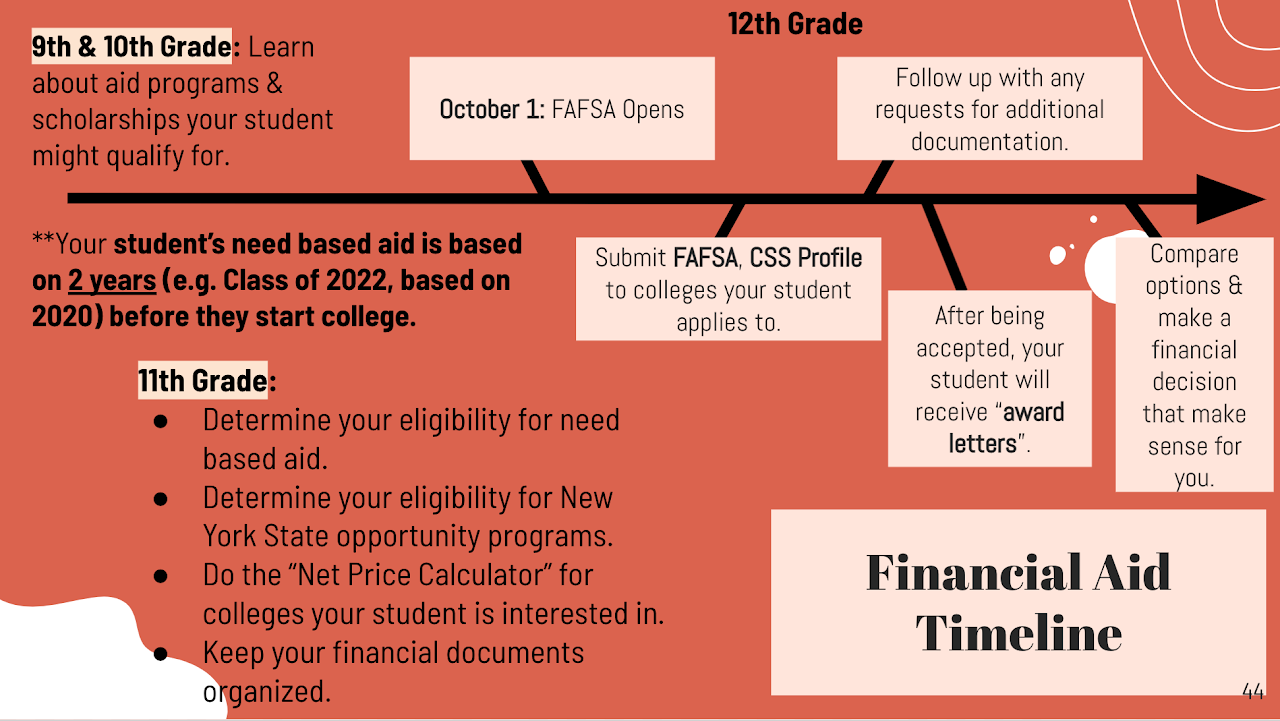

To over simplify the process, here’s a very basic version of how the financial aid and scholarships process works. In the fall of a student’s senior year, students and families complete forms that collect key information about their financial situation.

Each college then uses this information to determine the “financial aid package” that they will provide the student, considering how much money students need to attend, as well as other qualifications such as a student’s academic record. Every college approaches this differently - some emphasize providing students aid based upon their need (finances) and some emphasize their merit (academics). After a student is admitted to a college, they receive the financial aid package explaining the cost to attend and the types of aid they received.

Scrolling down ↓ on this page, you can find:

Financial Aid Timeline

Aid Application Forms & Links

How much aid might I/my family be eligible for?

Information on Colleges that “Meet 100% of Need”

Information on Merit Aid

How to Read Financial Aid Packages

How to appeal financial aid

List of Scholarships for 12th Grade Students (will update in the Fall of 25)

Applications Forms for Financial Aid

Types of Aid Applications

FAFSA: Primary financial aid form. Required by all colleges for the financial aid process. Determines eligibility for need-based financial aid from the federal government (Pell Grant, Federal Loans, Work Study). Even if you do not qualify for aid, many colleges require the FAFSA to be filed in order to consider students for merit scholarships.

TAP: New York State Residents for NYS colleges only. Determines eligibility for need-based financial aid from the New York State Gov't (TAP Grant, Excelsior, Enhanced Tuition Award).

>> The easiest way to complete the TAP is immediately after the FAFSA!

CSS Profile: Required by many private colleges (list here). The CSS Profile is a longer, more in-depth financial aid form that colleges use to gather additional information about your family’s financial situation.

NYS Dream App: NYS DREAM Act is a new state program that makes undocumented students and others (including students whose custodial parents live out of state) eligible for grants and scholarships within New York State, such as the TAP and Excelsior Scholarship.

Information for Filing FAFSA (Students & Families, Class of 2025)

In order to be considered for financial aid, it is highly important that all your financial aid documentation is submitted to each and every college on your list.

Submitting the FAFSA. The FAFSA is the primary form for receiving financial aid, and should be sent to all colleges you are applying to, including CUNY!

Creating an FSA ID: In order to be ready to submit the FAFSA, both the student and their parent(s)/legal guardian(s) depending on the situation will need an FSA ID. This is like a login account to complete the FAFSA. It is unique to each person and associated with the individual’s SSN; so, if a parent already made one for themselves or for filing for a sibling, they do not need a new one.

Who needs an FSA ID? In addition to the STUDENT, the student’s PARENT(S) also will need to complete an FSA ID. Which parent or parents need to make one depends on factors such as marital status, tax filing status, and if parents live together or not. Students with remarried parents may also need step-parents to complete an FSA ID. This SUPER HELPFUL CHART explains which parent(s) need an FSA ID!

The student action! [Walkthrough video from 0 to 34:00] The student needs to login with their FSA ID and answer questions relevant to their demographics and financial situation (if they the student filed taxes, etc.). This is also where the student can add up to 20 colleges they are applying to, who will receive the FAFSA.

Under the “Personal Circumstances” section, the FAFSA asks: “Tell Us About the Student’s Parents”. This will ask questions - such as marital status, etc. - that helps determine which parent will complete the “parent” section. After this, it will ask the student to “Invite Parent(s) to the FAFSA Form”. Parents will then get an email inviting them to contribute to the student’s form. At the end, the student will be asked to “sign” - which is essentially submitting their own student section of the form.The parent section! [Walkthrough video from 34:00 onward] The parent can use the email sent to them by the student, login with their own FSA ID, then accept the students’ invitation.

The FAFSA should now automatically import financial information from the parents’ taxes, as long as they are able to use the Data Retrieval Tool. This means that the FAFSA may seem … very short. That’s true! It will ask for (1) Annual Child Support (2) Total Cash, Savings, Checking ... as of THE DAY YOU DO THE FAFSA (3) Investments - do NOT include primary home (4) Network of business or farm. Please note the FAFSA has changed the small business exclusion - more on this here. If you don’t file taxes, no worries, you can still enter the information manually.Parent consent: That being said, parent(s) must provide consent and approval to share information with the IRS and have the IRS import tax information into the FAFSA form. This is a component of the new FAFSA. This is regardless of if your parent(s) have a social security number (SSN), file tax returns, etc. If you don't consent to giving the IRS access, the student will no longer be eligible for aid. I know it sounds scary, but it just means the federal tax information will be directly input from your taxes to your FAFSA. This video helps explain this new process.

Information for Filing the TAP

Direct Link to the TAP Application: https://webapps.hesc.ny.gov/hescpin/main

Who should complete the TAP Application: Students considering attending any college in New York City/State (public or private) whose family income is less than $125,000 a year, and students considering Macaulay Honors college.

Slides on how to complete the TAP are here. The TAP uses parents' NYS Taxes from the year 2023 (picture of NYS Taxes, the IT-201 here). More on the TAP is here.

Tips for completing the TAP:

Click "Start My Application" then click the blue link that says "First Time Users Click Here to Register With HESC" to set up your account.

Much of your information will be automatically input from the FAFSA, within 3 days after your FAFSA has been completed. The application is short, and usually takes 15-20 minutes.

You'll need your parents' 2023 New York State taxes (NY-201, tax form with a little picture of NYS in the corner) to complete the TAP.

Remember, you can only add one college to your TAP right now, and it doesn’t matter what that college is (as long as it’s located in New York). When you make a decision at the end of April about where you will attend, you will log back into your TAP application and enter the correct college.

To "sign" the TAP at the end, your parents need their driver's license number OR you can print out and hand sign the paper.

If you need to upload a supporting document, go to this direct link!

Information for Completing the CSS Profile

Some colleges - mostly private colleges, but some out-of-state public colleges such as University of Michigan and UNC-Chapel Hill - require an additional financial aid form, called the "CSS Profile". It's like a more in-depth version of the FAFSA that asks more questions. For colleges that require the CSS Profile, which is available as normal, the colleges will likely still require the CSS profile be completed around the same time as students are applying. A walkthrough video showing the CSS Profile step-by-step is here: https://www.youtube.com/watch?v=31PTmh6nLz0

To get started, go to https://cssprofile.collegeboard.org/ and select "Sign In for 2025-26". Students then sign-in with their existing College Board login, from taking the PSAT and SAT. Using your custodial parents' 1040 and relevant documents (below) answer the questions.

In the section titled "Academic Plans" add the colleges you are applying to that require the CSS Profile. Some will also require IDOC - essentially that you upload pictures of all your financial documents - so check to see if you need to upload pictures/scans of any files. On this page, you can also see which colleges quire IDOC (far right column).

For the CSS Profile, non-custodial parents need to also create an account and contribute their financial information for students - more on this here. Students who have little to no contact with their non-custodial parent may qualify for a waiver. More information on that process here.

For the CSS Profile, you may also need other documents - Here are other documents that are helpful/may be required:

-Parents W2 or 1099 forms

-Benefits/Public Assistance Statement

-Unemployment Letter or 1099-G

-Business Supplement / Schedule C

-Investment Statements

-Current bank account statements

How Much Aid am I/my family Eligible for?

I’ll say it one more time: affordability and financial aid are incredibly individual. What types of colleges might be a good financial fit for one student may not work for another. It’s incredibly important that you design your college list with an awareness of what is affordable for your family and what types of institutions might have financial aid programs that work for you.

Start by reviewing this chart to understand eligibility for need-based aid. Then, complete the NET PRICE CALCULATOR for several colleges on your list. This will help you understand if/how much aid you may be eligible for. The net price calculator is a tool offered by all colleges, where you can provide information about your family’s finances, and receive an estimate of what that college will cost to you. This is a great way to see if your family may be eligible for some “need-based aid” (aid based on family finances).

Understanding Types of Aid

Need based aid (grants, scholarships, loans and work-study opportunities) given to students because they and their families are not able to pay the full cost of attending a certain college. Need-based aid is awarded based upon a determination made by the college of how much students can pay for college. Many colleges provide a lot of need-based aid for students!

Need based aid comes in the form of grants from the federal government for low income students (PELL grant), grants from the state government for low income students (TAP grant for students who stay in NYS), and grants from the colleges (individual institutions provide need-based grants for students to make their institutions more affordable). Students with high need can also qualify for programs such as federal subsidized loans and work-study.

Am I eligible for need-based aid? The formula to determine your eligibility for financial aid looks largely at the number of people in your family and your family income. Some colleges will consider other factors that can change this formula, such as the value of home, savings, and investments. To qualify for the federal PELL grant, families generally have an income less than $60,000 and for the state TAP grant, families generally have an income less than $125,000. Many private colleges award need-based aid based on the cost of their college and how much they think you would need to make the college affordable, meaning families that make more -- but still cannot pay full tuition -- receive some aid each year.

Again, the best way to determine your eligibility for your family’s unique situation is to use the Net Price Calculator.

Merit aid. Merit aid is financial assistance provided for academic, athletic, or other recognizable traits and qualifications. Sometimes merit aid is applied without a separate application. In cases like this, colleges will review a student’s application and automatically apply a merit award. Sometimes a merit award requires a separate application or requires you to check a box when you apply. Some merit programs are for specific talents or skills (for example, a community service based award or a merit award for women in STEM).

Merit scholarships vary widely by institution. It’s important to do your research to identify what merit scholarships are available and what qualifications are required. I recommend starting with a Google Search (College Name + Merit Scholarship) -- this will usually bring you to the college's financial aid page, where you can see what types of merit scholarships they offer and how to be eligible for these.

How do I get a merit scholarship? You do not need to be an astounding student to receive some form of merit aid. Instead, merit aid is awarded to students whose academic qualifications (usually determined by GPA, rigor of classes, and standardized test scores such as SAT/ACT) are above those for the institution that the student applies to. Some merit scholarships are applied automatically by colleges based upon your application to that college, others require that you complete additional information or forms to apply. Some merit scholarships are non-academic, such as for artistic skill or community service. The most selective institutions in the United States (think, Ivy League + many top-tier institutions) don’t offer any merit scholarships, and instead focus entirely on need-based aid to support students.

High School Grades Could Be Worth $100,000. Time to Tell Your Child?

Institutional Merit Scholarship Search Resources:

It sounds simple but... Google! "College Name + Merit Aid or Scholarship". Most colleges publicize information on their websites.

Average Merit Aid Spreadsheet

Naviance also has a merit scholarship search tool!

Private Colleges That Meet 100% of Need

In addition to our amazing public college systems, CUNY and SUNY, another college option that can be affordable for families who qualify for significant need-based aid are colleges that "Meet 100% of Demonstrated Need".

Understanding Financial Aid Awards

One of the biggest components of making a final decision for which college or program to attend is the cost of attending the college. It is really important the students and families make thoughtful financial decisions, based on what is affordable for the family. Colleges provide financial aid award letters that explain their costs, the financial aid and scholarship, as well as loans that students and families are being offered. Unfortunately, sometimes these letters can be confusing and sometimes purposefully deceptive. Below, I’ve provided guidance on how to read financial aid award letters to compare college costs.

What are financial aid award letters?

Financial aid award letters summarize the types and sources of student financial aid available to help the student finance the cost of his or her education. As mentioned, a financial aid award letter includes information about the costs to attend the college (tuition, housing, other expenses) as well as the amount of aid the student is receiving (need-based aid & merit scholarship, loans, work study).

These letters usually are provided along with an acceptance or within 6 weeks of a student’s admission to a college, as long as all necessary financial documentation is filed. These letters are typically found on a student’s application or financial aid portal (online), but can also be sent via paper mail or email. A guide with several samples is here. A standard SUNY sample letter is here.

What is included on a financial aid award letter?

Cost of Attendance.

An award letter should include the total cost of attending the college. Many colleges will include a breakdown of costs, as well as a total expected cost of attendance that includes every cost associated with college attendance.

Direct Costs. Are the costs that show up on the student’s bill.

Tuition - The cost of classes. This is often the largest amount of the Cost of Attendance, but it is important to remember that tuition is NOT the total cost of attendance.

Room & Board - The cost of living & eating on campus.

Fees - Most colleges bill a few additional fees to students, for things like activities on campus.

Indirect Costs. These are the costs that are not billed directly to the student/family, but are part of the expected cost of attending a college, such as travel expenses, textbooks, personal supplies, etc. These are often included to give students and families an accurate picture of what the true cost of college is.

Textbooks - No matter how cheaply you prepare, textbooks and other resources cost money. It is important to consider these costs when planning.

Travel Expenses - This is an estimate of the costs of traveling to and from campus for the student.

Personal Supplies - Many colleges include an estimate of personal expenses in their letter, knowing that students will also need to pay for clothes, toiletries, etc.

“Free Money” - Grants & Scholarships

Grants. Grants are awards given to students that do not need to be paid back and are based on family income/need for financial aid. On most award letters, you will see the following grants.

PELL Grant. The PELL grant is the federal (national) grant. Families who qualify for PELL grants typically make less than $60,000 a year. The grant is up to $7,395. The PELL grant is based on information reported in the FAFSA.

TAP Grant. The TAP grant is the primary New York State grant. Families who qualify for the TAP grant typically make less than $125,000 a year. It can be applied to any New York State college, public or private. If a student is accepted to a college within NYS, the TAP grant will usually be listed automatically on the award letter. To actually receive the TAP award, families MUST have completed the TAP application (comes immediately after the FAFSA or can be done separately).

FSEOG Grant. This is a smaller grant (in amounts from $100-4,000) that is funded by the federal government and provided by some colleges for low income students.

Institutional Grants. Individual colleges provide their own institutional grants (sometimes they call them scholarships, even though they are need based) to help students with financial need attend their college. These might have all sorts of different names - e.g. “Student Success Grant”, “Presidential Grant”.

Scholarships. Scholarships are awards given to students that do not need to be paid back and are based on student merit (strength of academic or personal profile). These are generally awarded by the college themselves. Many scholarships are automatically applied, some students need to apply separately. When reviewing scholarship awards, make sure to check the following:

>> Is the amount of scholarship they provided a total over four years or a yearly amount? Many colleges are tricky and will say something like - “We are awarding you $40,000 in scholarship!” but what they mean is they are awarding $40,000 over four years of a bachelor's degree, and the student is only receiving $10,000 each year.

>> Is this scholarship renewable every year? What are the requirements for maintaining the scholarship? You want to make sure that the student will receive the same scholarship all four years.

Loans. Loans are money borrowed that you have to pay back. A loan must be paid back with an extra charge called interest. The federal government provides relatively low interest student loans (subsidized and unsubsidized stafford loans) that many students take out to help fund their education. Students and families should be very careful about taking out loans beyond the federal student loans, and should have a thoughtful conversation about what is affordable and manageable based on family income. An overview of the different types of loans is below. The FAFSA must be filed for students to receive federal student loans.

Federal Direct Subsidized Loan - Students who qualify for need-based aid typically qualify for the federal subsidized loan, with a first year loan amount up to $3,500. For the subsidized loan, the federal government pays off interest until 6 months after graduation.

Federal Direct Unsubsidized Loan - Any student who files the FAFSA (regardless of need), can take out the federal student loan, in the amount of up to $5,500 for first year students. For the unsubsidized loan, students need to pay the interest or can wait to pay until they graduate, in which case the interest will be capitalized.

Each year in college, students become eligible to take out more federal student loans (about an additional $1,000 per a year).

The current interest rate for Direct Subsidized and Unsubsidized Federal Loans is 3.73%. More on loan rates here.

More information on Federal Student Loans here. Loan repayment simulator here.

Parent Plus Loan - The federal government also provides a loan for parents to support their child’s education. The Parent Plus loan can be taken out by parents/legal guardians to help support their child's education. Parents can borrow as much as the remaining cost of the college after all other aid is applied. This could be a pretty big loan, and families MUST be extremely careful with taking out this loan -- this is often where students and families overborrow. More details here. Interest rate is 6.28%.

Private Student Loan - Private loans are made by private organizations such banks, credit unions, and state-based or state-affiliated organizations, and have terms and conditions that are set by the lender. Private student loans are generally more expensive than federal student loans. This explains private v. federal student loans well. Families and students should be very careful with private loans and lenders, as they can have variable rates and can have practices that lead to overborrowing.

Work Study Through the federal work study program, the federal government gives money to colleges to pay students; these paid part-time jobs that help students pay for part of their college cost, usually with a total maximum limit of earnings around $2,000-$3,000 a year. Students must apply for work on campus and then work in order to get this work-study money -- in most cases, it comes in the form of a paycheck, that can then be applied towards college.

Tools for Comparing Award Letters

There are a lot of good tools available to compare award letters, so you can make the most informed decision about which college is affordable for your family. Below are three tools which allow you to compare across multiple financial aid letters:

Description of how to read sample from Buffalo State

Financial Aid Award Letter Presentation (SUNY + CUNY walkthrough videos included)

3 Deceptive Award Letter Tricks to Watch Out For!

Parent Plus Loans being included in the financial aid section. Parent Plus loans can be taken out in any amount to cover the remaining cost of college. Many colleges deceptively include these in the awards list to make it seem like they are free money not loans.

Presenting a net cost figure, as opposed to a net price figure. Colleges will sometimes highlight the net cost, meaning the amount you have to take after loans are applied, not the net price. They may include Student Direct Loans and Parent PLUS loans in the financial aid award, making it seem like you don’t have to pay a lot (when, in reality, you’ll be taking out a lot of loans).

Not including the total cost of attendance or only including tuition. Knowing how much the college costs to attend is crucial in making a smart decision! $30,000 might seem like a lot in grants and scholarships, but not if the college costs $75,000 -- you still have to pay the remaining $45,000. Don’t get deceived by “big” scholarship amounts. Be careful to check how much the college will cost, not just how much they are giving you in aid.

Appeals & Special Circumstances

If there is a significant change in your family’s finances — such as a drop in income or unexpected medical expenses — you can submit an appeal asking the financial aid office to review your award. Be ready to provide proof of the change in your circumstances, such as bank statements, pay stubs or medical bills.

Similarly, if a college does not offer you enough aid to attend, you can also appeal and ask for more aid. Usually, this works best if you can offer a specific amount that would make the college affordable. College and financial aid offices will work with you, to the extent that they can, to make the institution affordable. Small appeals ($5,000- 8,000) are much more likely to be approved than large requests.

Some colleges have a specific format or process you must follow to appeal. To find out if there is an official appeal process/form, go to the financial aid section of the school’s website or google “financial aid appeal” with the name of the school. Some will require you to fill out an on-line form or to follow a specific format.

Resources for Appeals:

Outside Scholarship Resources

Many companies, foundations, community organizations and clubs sponsor grants or scholarships. Grants and scholarships from these private organizations are called outside, or private, scholarships. These can be big scholarships that cover a lot of costs, to small scholarships for books or expenses. Outside scholarships can be very helpful in funding your college education, but you are more likely to get financial support from the college or institution you attend. In most cases, you shouldn’t plan to rely entirely on outside scholarships to fund your education, but again, they can definitely help!

College Green Light- www.collegegreenlight.com for low income and first generation students

Fast Web - www.fastweb.com

Federal Trade Commission Scholarship Scams Info - https://www.consumer.ftc.gov/articles/0082-scholarship-and-fnancial-aid-scams

FinAid - www.finaid.org

Free Guide to Financial Aid: http://www.affordablecollegesonline.org/financial-aid/financial-aid-for-online-colleges/

Hispanic Heritage Youth Awards - http://www.hispanicheritageawards.org/

College Peas Scholarship - http://www.collegepeas.com/scholarshipgreen/

National Association of Student Financial Aid Administrators - http://www.studentaid.org

Higher Education Services Corporation - www.hesc.state.ny.us

Scholarship Database - http://www.free-4u.com/

United Negro College Fund - http://www.uncf.org/index.asp

Ayn Rand Essay Scholarships - http://www.aynrand.org/site/PageServer?pagename=education_contests_%20atlas >

Black Alliance for Educational Options Scholarships - http://www.baeo.org/

Brand Essay Competition - http://www.instituteforbrandleadership.org/IBLEssayContest-2002Rules.html

Coca-Cola Scholars Foundation - http://www.coca-colascholarsfoundation.org/

College Board Scholarship Search - http://apps.collegeboard.com/cbsearch_ss/welcome.jsp

Easley National Scholarship Program - http://www.naas.org/senior.php

Educator.com - Annual $2,400 Student Scholarship https://www.educator.com/scholarship/

Federal Scholarships & Aid Gateways 25 Scholarship Gateways from Black Excel -http://www.blackexcel.org/25scholarships.htm

FinAid: The Smart Students Guide to Financial Aid scholarships - http://www.finaid.org/

Good Call - https://www.goodcall.com/scholarships/

Guaranteed Scholarships - http://www.guaranteed-scholarships.com/

HBCU Packard Sit Abroad Scholarships (for study around the world) - http://www.sit.edu/studyabroad/scholarships.htm

Hispanic Women’s Corporation - http://www.hispanicwomen.org/contentpage.php?id=10

Historically Black College & University Scholarships - http://www.iesabroad.org/study-abroad/scholarships/hbcu-scholarship

International Students Scholarships & Aid Help - http://www.iefa.org/

National Assoc. of Black Journalists Scholarships (NABJ) - http://www.nabj.org/?page=SEEDScholarships

New Visions - Tons of Scholarships for NYC Students - http://www.newvisions.org/scholarships-for-new-york-city-students/scholarships-for-new-york-city-students

New York Scholarships, Resources and Information - http://www.college-scholarships.com/new_york.htm

Presidential Freedom Scholarships - http://www.learnandserve.gov/home/site_map/index.asp

Scholarship & Financial Aid Help - http://www.blackexcel.org/fin-sch.htm

Scholly - www.scholly.com

ScienceNet Scholarship Listing - http://www.cse.emory.edu/sciencenet/undergrad/scholarships.html

Student Inventors Scholarships - http://www.invent.org/collegiate/

The Roothbert Scholarship Fund - http://www.roothbertfund.org/scholarships.php

Tuck Sleep Foundation- https://www.tuck.com/sleep-scholarships/

William Randolph Hearst Endowed Scholarship for Minority Students - http://www.apsanet.org/opps/

Xerox Scholarships for Students - http://www.xerox.com/jobs/minority-scholarships/enus.html

Financial Aid Resources for Hispanic Students - http://www.onlinecolleges.net/for-students/financial-aid-hispanic-students/

New App for Undocumented Students To Find Scholarships - http://ww2.kqed.org/news/2016/04/03/new-app-helps-undocumented-immigrants-find-college-scholarships